In a previous post, Why Marriage is so Important in Estate Planning, we talked about how various aspects of the law, and different government agencies, favor marriage. Marriage can provide many benefits for couples that decide to tie the knot. However, to reiterate, marriage is a personal decision, and is not for everyone for any number of reasons. In this post, we will provide some information for unmarried couples who are looking to provide for their partner after their death.

Before we get into the available planning options, it is important to understand two initial topics:

- Intestacy, which is the statutory procedure that occurs if you die without a will, and

- Common law marriage, and what may happen if you hold yourself out as a married couple.

What Happens When You Die Unmarried and Without a Will?

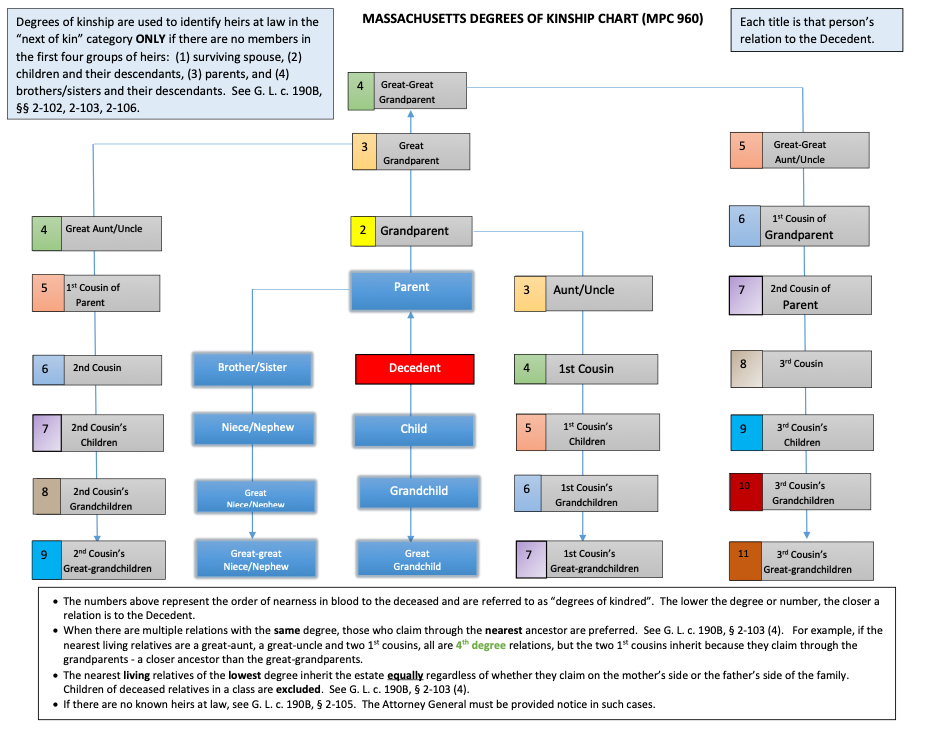

If at the time of your death you do not have at least a will, you are deemed to die “intestate.” This is a statutory means for distributing your assets and property. Effectively, the state directs to whom your assets are distributed, and at what percentage; i.e. the state makes a will for you.

Depending on family circumstances a surviving spouse will either receive all of an intestate estate from their deceased spouse, or they may only receive a fractional share based on a formula in which they share with other heirs of the deceased spouse. If you are not married, you/your partner very likely are not considered the other’s surviving spouse. See below about common law marriage for a possible exception.

Regardless of your intent, a judge or court cannot deviate from the intestacy statute. As you can see, if you are not married to your partner, and you do not have any estate planning documents, your surviving partner may not be entitled to any of your assets or property(unless jointly owned with survivorship rights or via beneficiary designations). If you have children together, this could also lead to you minor children inheriting your estate which raises additional issues. For more on gifts to minors, see our blog: Making Lifetime Gifts and Leaving Inheritances to Minors.

This is why it is important to set up even a basic will based estate plan to avoid intestacy.

For more on New Hampshire intestacy, read our article: What Happens When You Die Without a Will in New Hampshire?.

For more on Massachusetts intestate succession, read our article: Massachusetts Intestacy: What Happens When You Die Without a Will?.

Common Law Marriage in Massachusetts and New Hampshire

Common law marriage is a legal marriage where the couple never got formally married and never obtained a marriage license or certificate. Whether common law marriage is recognized in a state can have implications on inheritance.

Common law marriage is not recognized in Massachusetts. This means that if two unmarried people are cohabitating, have minor children, and one of the partners/parents passes away, the estate of the deceased parent would flow through to the minor child, not the surviving parent. If you do not have a child together, your estate would distribute pursuant to the Massachusetts intestacy statute (see above). In Massachusetts, your long-term, live in, boyfriend/girlfriend, has no legal interest in your estate, regardless of whether you share a child.

New Hampshire recognizes a version of common law marriage for inheritance purposes only for couples who acknowledge each other as husband and wife, are generally reputed to be such, for 3 years. If a couple satisfies these statutory requirements, upon the death of one of the partners, the couple may be deemed to have been married for inheritance purposes, and the survivor will inherit all or some of the deceased partner’s estate. See RSA 457:39. This could be the intestacy exception I mentioned above.

Estate Planning for Unmarried Couples

Estate planning options are not inherently different for unmarried couples compared to married couples. As we discussed in a previous post, married couples do enjoy the luxury of tax and other benefits, however, the ability to actually provide for a partner does not require marriage – it requires careful and intentional planning. For unmarried couples looking to provide for their partner after death, the goal really is to ensure the intestacy statute does not apply by executing, at least, a will. Further steps similar to those necessary to remove property from their probate estate can ensure a more efficient, direct transfer.

The first option are outright distributions via, will, trust, or lifetime gift to your partner. Unmarried couples can create wills and trusts leaving all or some of their assets and property to the partner, or naming their partner as beneficiary of their trust. It is also possible to make lifetime gifts of money or other assets.

However, unmarried couples will not be able to take advantage of the estate a gift tax benefits as married couples can. This means for lifetime gifts, any gift to a partner over $18,000 in 2024, will be subject to gift tax, unless the donor eats into their lifetime gift tax exclusion amount. Unmarried couples are also unable to implement trust planning to take advantage of the unlimited martial deduction.

Other options include jointly held property and beneficiary designations. These designations will also remove these assets from your probate estate. This could include:

- Jointly held property where there is a right of survivorship. This could be bank accounts or real estate held as “Joint Tenants with Rights of Survivorship”;

- Bank accounts held in trust, or with payable on death (POD) designations; and

- Beneficiary designations for bank accounts, retirement accounts, investment accounts, life insurance, etc.

If You Have Minor Children

As mentioned above, in Massachusetts, and if you don’t meet the statutory common law marriage requirements in New Hampshire, if you are unmarried and have minor children with your partner, and one of you passes away, your estate (assets and property) will bypass your partner and be left directly to your minor child. While your partner as surviving parent may have control over holding and distributing those funds on behalf of your child, without advanced planning, your child would have immediate, full, unfettered access to those funds upon reaching the age of majority, which is typically 18.

It is also extremely important to name a guardian for your child(ren) should the unthinkable happen and both of partner-parents pass away. This will ensure that your child(ren) is/are taken care of by the person or persons of your choosing, and not by a stranger appointed by a judge. This can also help to prevent your child from being placed into custody of child services.

Financial and Health Care Decisions

Another important aspect of estate planning, especially for unmarried couples, is appointment of a health care agent and attorney-in-fact. Should you become incapacitated without a health care proxy and/or a durable power of attorney naming your partner as your healthcare agent and attorney-in-fact, your partner may have little or no right to participate in your medical care or to assist and protect your financial or other interests.

This is not to say that married couples have a leg up in this instance, because they too need to have these documents, but hospitals will tend to default to spouses for medical decisions. Absent a power of attorney or health care proxy, if court intervention is required, a court would likely appoint a spouse as a guardian and/or conservator. If you are unmarried and want your partner to be able to make these decisions on your behalf, executing a Durable Power of Attorney and Health Care Proxy/Advanced Directive appointing your partner as your Agent, is essential.

For a personalized review of your current estate, schedule a free consultation to discuss estate planning options, and determine what plan will be best for you and your family.

No information in this blog post is to be construed as, nor is intended to be, legal or tax advice. Consult with competent legal counsel and/or tax professionals prior to taking any action. Do not rely on any information contained in this blog post as the law changes from time-to-time and this blog post may not be updated to reflect those changes.

© Zuccaro Law, LLC. All Rights Reserved.