Marriage is a personal decision. For one reason or another, many couples are deciding that marriage isn’t right for them. Maybe this is because of previously failed marriages and not wanting to go through a contentious divorce process again; a lack of belief in the institution; not thinking a license or certificate defines a relationship, or not wanting to feel “tied down,” among other reasons. This is perfectly fine and acceptable for couples comfortable with this arrangement, and when it comes to estate planning, there are options available to provide for one another should you choose to do so.

The law, however, favors marriage, and provides many advantages for legally married couples including benefits for tax planning, asset distribution, veterans, and long-term care/nursing home planning. We would never advise a couple to get married simply to take advantage of these financial benefits, but it is worth a look, particularly for asset protection when it comes to nursing home care, especially if you jointly own a home together.

In this post we will look at:

What Happens When You Die Unmarried and Without a Will?

As mentioned above, estate planning options are available to provide for your partner, regardless of if you are married. It is also important to understand what happens if you die without a will. While you may consider your unmarried partner your “spouse,” the law very likely does not, and what you think may happen to your assets and property, may not be what actually happens.

If at the time of your death you do not have at least a will, you are deemed to die “intestate.” This is a statutory means for distributing your assets and property. Effectively, the state directs to whom your assets are distributed, and at what percentage; i.e. the state makes a will for you.

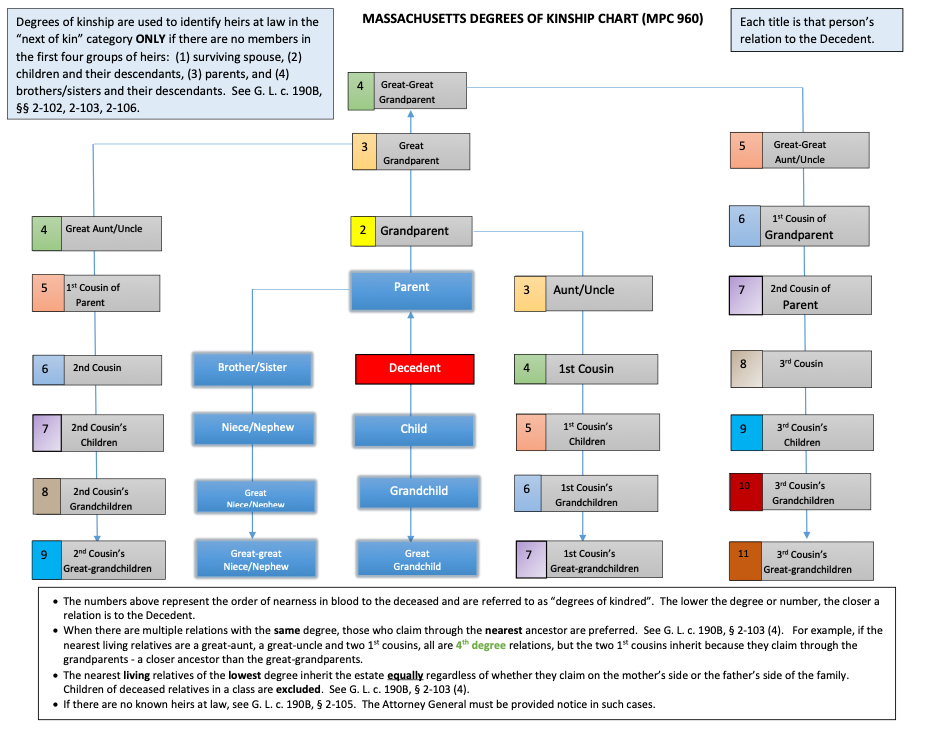

Depending on family circumstances a surviving spouse will either receive all of an intestate estate from their deceased spouse, or they may only receive a fractional share based on a formula in which they share with other heirs of the deceased spouse. If you are not married, you very likely are not considered a surviving spouse.

Regardless of your intent, a judge or court cannot deviate from the intestacy statute. As you can see, if you are not married to your partner, and you do not have any estate planning documents, your surviving partner may not be entitled to any of your assets or property (unless jointly owned with survivorship rights or via beneficiary designations). If you have children together, this could also lead to you minor children inheriting your estate which raises additional issues. For more on that, see our blog: Making Lifetime Gifts and Leaving Inheritances to Minors.

This is why it is important to set up even a basic will based estate plan to avoid intestacy.

For more on New Hampshire intestacy, read our article: What Happens When You Die Without a Will in New Hampshire?.

For more on Massachusetts intestate succession, read our article: Massachusetts Intestacy: What Happens When You Die Without a Will?.

Common Law Marriage in Massachusetts and New Hampshire

In our discussion on intestacy, I mentioned that if you are not married, you very likely are not considered a surviving spouse. In some states, there is a way around that – common law marriage. Common law marriage is a legal marriage where the couple never got formally married and never obtained a marriage license or certificate. Whether common law marriage is recognized in a state can have implications on inheritance.

Common law marriage is not recognized in Massachusetts. This means that if two people are cohabitating, have minor children, and one of the parents passes away, the estate of the deceased parent would flow through to the minor child, not the surviving parent. If you do not have a child together, your estate would distribute pursuant to the Massachusetts intestacy statute. In Massachusetts, your long-term, live in, boyfriend/girlfriend, has no legal interest in your estate, regardless of whether you share a child.

New Hampshire recognizes a version of common law marriage for inheritance purposes only for couples who acknowledge each other as husband and wife, are generally reputed to be such, for 3 years. If a couple satisfies these statutory requirements, upon the death of one of the partners, the couple may be deemed to have been married for inheritance purposes, and the survivor will inherit all or some of the deceased partner’s estate. See RSA 457:39.

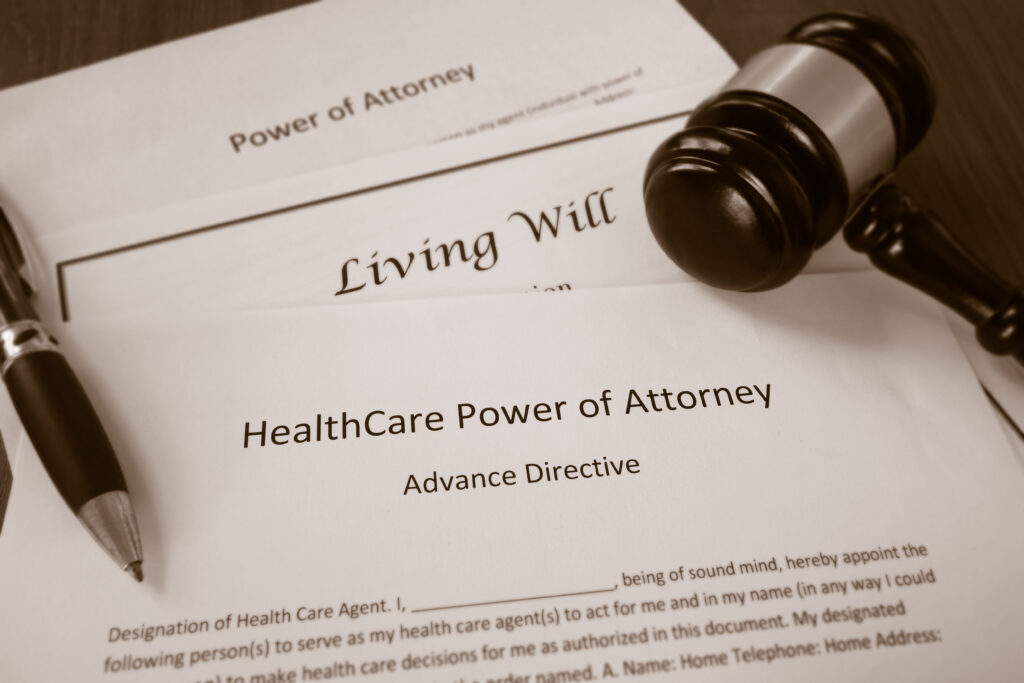

Making Financial and Healthcare Decisions for Unmarried Partner

Should you become incapacitated without a health care proxy and/or a durable power of attorney naming your partner as your healthcare agent and attorney-in-fact, your partner may have little or no right to participate in your medical care or to assist and protect your financial or other interests.

This is not to say that married couples have a leg up in this instance, because they too need to have these documents, but hospitals will tend to default to spouses for medical decisions. Absent a power of attorney or health care proxy, if court intervention is required, a court would likely appoint a spouse as a guardian and/or conservator.

Tax Benefits of Marriage

For estate planning purposes, there are generally two taxes that are planned for, the gift tax and estate tax. An estate tax is a tax on your right to transfer property at your death. It is paid from an estate prior to distribution to heirs/beneficiaries.

There is a federal estate and gift tax, and Massachusetts imposes a separate state estate tax on estates in excess of $2 million. New Hampshire has neither a state estate nor gift tax. For more on the Massachusetts estate tax, read our blog: New Massachusetts Estate Tax Law: What is it, and How to Plan Now.

When gifting, there are two exclusion amounts: an annual gift tax exclusion amount, and a lifetime exclusion amount. For 2024, the annual gift tax exclusion amount is $18,000. This means that you are allowed to gift each recipient up to the annual exclusion amount ($18,000 in 2024) tax-free.

You are allowed to make as many gifts each year, up to $18,000 per person, that you’d like. Once a gift to one person exceeds the annual exclusion amount, you either pay the gift tax, or you can eat into your lifetime exclusion amount, and the gift is tax-free.

The federal estate tax exemption and the lifetime gift tax exemption amounts are ONE exemption (for 2024, $13.61 million). This means that if you avoid paying taxes on an otherwise taxable gift by eating into your lifetime gift tax exclusion, you are reducing your federal estate tax exemption amount. The current federal estate and gift tax exemption amounts will be sunsetting in 2026. For more on planning for these changes, read our post: Federal Estate Tax Changes are Coming! How to Prepare Now.

Gift and Estate Tax Benefits for Married Couples

Married couples can take advantage of various tax planning tools which are not available to unmarried couples. Married couples are allowed to gift tax-free to each other, and if they properly plan, may be able to completely avoid estate taxes on the death of both spouses.

Some examples of the gift and estate tax benefits afforded to married couples include:

- The gift and estate tax exemption amounts for married couples are doubled. This means that, based on 2024 exclusion amounts, married couples can gift up to $36,000 per person each year, and have a lifetime gift and estate tax exclusion amount of $27.2 million.

- Next, the gift tax generally does not apply to married couples. They can typically make unlimited tax- free gifts to one another.

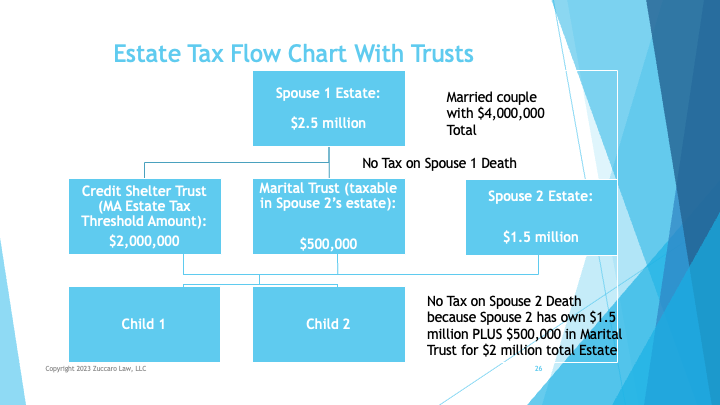

- Third, married couples can take advantage of the unlimited marital deduction upon the death of the first spouse. A married couple can avoid estate taxes on the assets of the first spouse to die if they are left outright to the surviving spouse. Depending on the value of a couples assets, this could create an estate tax issue upon the death of the surviving spouse. To avoid this, married couples can utilize trust planning to take advantage of the unlimited marital deduction while also removing some of the assets of the first spouse to die from the estate of the survivor.

- For an unmarried couple, estate taxes would be due upon the death of the first partner.

How Marriage Can Reduce or Eliminate Gift and Estate Taxes

Even though you may not be married to your partner, you may still want them to benefit from your estate after your death, but estate taxes will reduce what your surviving partner will inherit. Even if individually neither estate is taxable, if, upon the death of the first partner the survivor inherits all of their assets, the surviving partner may then have a taxable estate.

For taxable estate, there are many ways to reduce or eliminate estate tax exposure including lifetime gifting and spending down assets, which unmarried individuals can also take advantage of. Married couples can utilize trust planning to reduce or eliminate estate taxes from both estates so that the ultimate beneficiaries (typically the couple’s children) will inherit tax-free. Unfortunately, unmarried couples will not be afforded these same benefits of married couples.

A typical plan for married couples looking to reduce or eliminate estate tax exposure is a multi-trust plan working in conjunction with the unlimited marital deduction (assets from the first spouse to die pass TAX FREE to the surviving spouse).

This plan includes credit shelter/family (bypass) and marital trusts. The credit shelter trust (“CST”) is funded with the then estate tax exclusion amount, and the marital trust contains the balance. The result is the funds in the marital trust qualify for the unlimited marital deduction, and the funds in the CST qualify for both the marital deduction AND bypass the surviving spouse’s estate, and are shielded from estate taxes on the deaths of both spouses.

A plan like this, typically a QTIP (qualified terminable interest property) trust plan, places restrictions on the surviving spouse’s access to some of the funds. Ultimately, this married couple is able to shield upwards of $4 million from the Massachusetts estate tax. If this couple had a federally taxable estate ($27.2 million in 2024), additional trusts could be funded to shield money from federal estate taxes. There are additional trust options available to married couples as well. These plans would not be available to unmarried couples.

VA Benefits for Married Couples

Veterans with unmarried partners can also find themselves at a disadvantage. The U.S. Department of Veterans Affairs (VA) provides two financial benefit programs to qualified veterans or to their surviving spouses:

1) Non-service-connected pension, and

2) Dependents Indemnity Compensation (DIC)

We won’t get into the eligibility requirements for these programs in this post. For both the Survivor’s Pension and the DIC, the surviving spouse must satisfy certain marital requirements, which cannot be met by an unmarried partner. Otherwise eligible veterans looking to use these benefits for their unmarried partners, will not be able to do so. If the veteran has unmarried dependent children, they may be eligible for these benefits.

Marriage and Long-Term Care Planning

The IRS and VA aren’t the only agencies that provide marital benefits. Medicaid/MassHealth also provides benefits for married couples to protect assets should one partner need long-term care services, that would not otherwise be available to unmarried couples.

This is not to say that for these purposes, marriage provides some sort of magical ability to protect all assets. Married couples still face a tough road if one spouse needs nursing home care. This planning is complicated, and this section is not a Medicaid “how-to.” The fact remains that married couples have more options to obtain eligibility and retain more assets than a single person.

An institutionalized person will need to spend down their assets to $2,000 in MA, and $2,500 in NH. They further are only afforded a personal needs allowance of $72.80/mo. in MA, and $74/mo. in NH. This puts a financial strain on the family and potentially eliminates of any inheritance. Married couples also need to spend down, but if one spouse does not need nursing home care, then this “community spouse” will be able to save more. With proper pre-planning within the 5-year lookback period, more, or all, could have been saved for the family.

Some examples of marital benefits in nursing home planning include:

- The community spouse is currently allowed to keep up to $154,140 in countable assets. This amount is known as the Community Spouse Resource Allowance (“CSRA”);

- Medicaid will not place a lien on the couple’s home as long as the home is the principal residence of the community spouse;

- In certain situations, the community spouse may also keep a portion of the institutionalized spouse’s income;

- A community spouse is allowed a minimum monthly maintenance needs allowance (MMMNA), which is currently $2,465 through June 2024. This is the minimum amount of monthly income a community spouse is said to require to avoid spousal impoverishment. This can be increased to a maximum of $3,853.50 if shelter and utility costs exceed a set amount;

- When approved, if the institutionalized spouse has any assets exceeding the $2,000 asset limit still held in their name, they must be placed in the community spouse’s name within 90 days;

- Countable assets in excess of the CSRA can be converted into a compliant annuity to provide a community spouse with an income stream.

For a personalized review of your current estate, schedule a free consultation to discuss estate planning options, and determine what plan will be best for you and your family.

No information in this blog post is to be construed as, nor is intended to be, legal or tax advice. Consult with competent legal counsel and/or tax professionals prior to taking any action. Do not rely on any information contained in this blog post as the law changes from time-to-time and this blog post may not be updated to reflect those changes.

© Zuccaro Law, LLC. All Rights Reserved.