Divorces are difficult, stressful, and emotional. They raise issues, questions, and undoubtedly arguments about living arrangements; paying for multiple households; distribution of property; alimony; child support; visitation, and child custody, among other things. One thing that tends to get lost in the weeds is handling estate planning documents. Of course, every marriage and family is unique, but if you follow the typical course, you likely have named your spouse as your personal representative or executor, health care agent, attorney-in-fact, trustee, etc. You likely have left them the entirety of your assets through a will, trust, and/or beneficiary designations.

Now that you’re thinking of divorce, getting divorced, or your divorce is finalized, what impact does this have on these estate planning documents? Under Massachusetts and New Hampshire law, certain documents and designations are automatically revoked by divorce, and for other circumstances, you will need to manually change designations and retitle assets.

It is important to note that a divorce settlement agreement may address some of the below, or otherwise restrict your ability to change or retitle certain assets and beneficiary designations.

What if You Don’t Have a Will?

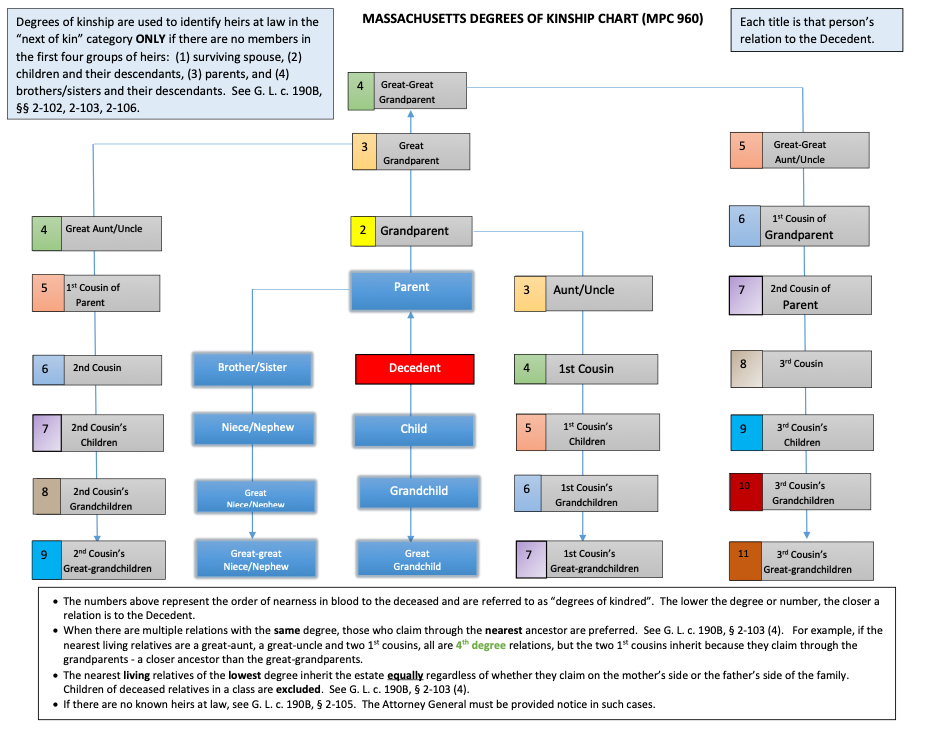

If you pass away without having a will, that is called dying intestate, and you become subject to your state’s intestate succession procedure. Intestacy is a statutory means for distributing your assets and property. Effectively, the state directs to whom your assets are distributed, and at what percentage; i.e. the state makes a will for you.

If you are married, your surviving spouse typically receives all or a major portion of your estate (your money, other assets, and property). Upon a divorce, your ex-spouse is no longer considered your surviving spouse for intestacy purposes.

In Massachusetts, this requires obtaining or consenting to a final decree or judgment of divorce – a judgment of separation is not considered a divorce for these purposes. See G.L. C. 190B § 2-802.

New Hampshire has not adopted the Uniform Probate Code, as is the case in Massachusetts. That said, however, New Hampshire law does also state:

“If, at the time of the death of either husband or wife, the decedent was justifiably living apart from the surviving husband or wife because such survivor was or had been guilty of conduct which constitutes cause for divorce, such guilty survivor shall not be entitled to any interest or portion in the real or personal estate of said decedent, except such as may be given to such survivor by the will of the deceased.“

RSA 560:19

For more on New Hampshire intestacy, click here for the New Hampshire intestacy statute.

For more on Massachusetts intestate succession, read our article here.

Automatic Revocation by Divorce

Wills and Revocable Trusts

Under both Massachusetts law and New Hampshire law, a divorce will automatically revoke revocable distributions of property to a former spouse. This means that distributions to a former spouse in a will and revocable living trust will be automatically revoked.

Further, any provisions nominating your former spouse in a fiduciary capacity (personal representative, executor, trustee, conservator, agent, or guardian) are also revoked. For both Massachusetts and New Hampshire, a judgment of separation that does not terminate the couple’s marital status is not a divorce for these purposes.

Health Care Proxy/Advanced Directives

Massachusetts law provides that a health care proxy will be automatically revoked by divorce or legal separation.

Similarly, New Hampshire law provides that advanced medical directives will be automatically revoked by divorce or legal separation.

Powers of Attorney

As noted above, in Massachusetts, an agent’s power pursuant to a Power of Attorney is revoked upon divorce. A judgment of separation that does not terminate the couple’s marital status is not a divorce for this purpose.

Pursuant to New Hampshire law an agent’s power under a Power of Attorney is terminated when “a petition for divorce, annulment, separation or a decree of nullity is filed with respect to the agent’s marriage to the principal….” See RSA 564-E:110.

Contracts and Beneficiary Designations Not Automatically Revoked by Divorce

Divorce will not automatically revoke contractual relationships nor beneficiary designations. If you named your spouse as a beneficiary on insurance policies, retirement accounts, stocks, and/or other accounts or investments, you will need to manually change these beneficiary designations.

Similarly, although revocable trust provisions concerning your former spouse are automatically revoked by divorce, irrevocable trusts are not automatically revoked by divorce – these trusts will also need to be manually updated. Questions may arise about whether these trusts can be decanted, which is the process of transferring property from an irrevocable trust to a different trust, but that is outside the scope of this article. There may be some state distinctions regarding this process.

Divorce and Property Ownership

When purchasing a home or other real estate with your spouse, title is typically taken as Tenants by the Entirety, which is a form of joint ownership only available to married couples. Upon divorce, a tenancy by the entirety automatically converts to a tenancy in common.

Even with this change, you will still own the property jointly with your ex-spouse. With a tenancy in common, each individual has an undivided interest in the property, an equal right to use the property, and the right to leave his or her interest upon death to whomever they choose. Ultimately, title will need to be changed on property held as tenants in common with your former spouse. Divorce does not automatically remove joint ownership rights. It is likely this would be addressed in a divorce settlement.

Don’t Wait to Make Changes

We always tell our clients that estate planning documents are fluid and should be updated, or at least reviewed, every 5-10 years, or upon the occurrence of a “major life event.” Divorce definitely falls into the category of a major life event.

While you’re in the midst of a divorce or perhaps you just recently finalized a divorce, you should make changes immediately; not so much to keep assets from your ex (or soon to be ex) spouse, but to prepare for an emergency – you probably don’t want your ex-spouse making healthcare or financial decisions on your behalf, and you probably want to make sure your ex-spouse can’t use a power of attorney to withdraw all your money.

- Upon filing for a divorce, or receiving the documents from your spouse, you should immediately change your health care proxy and power of attorney if they name your spouse as your Agent. These documents can be revoked upon the execution of a new ones. You should provide your new documents to your doctors and financial institutions so they have on record that your spouse is no longer to make medical or financial decisions on your behalf.

- If you have a more basic estate plan, you should update your will and revocable living trust to remove distributions to your ex-spouse, and choose a new personal representative/executor, trustee, etc. More detailed and complex estate plans with irrevocable trusts may need to be addressed later on depending upon the circumstances.

- You should also change the beneficiary designations on your life insurance and retirement accounts, etc. This is particularly true for after a divorce is finalized.

Remember that a settlement agreement may restrict your ability to make certain changes, or perhaps require you to put back certain designations that you have changed.

These updates and changes are done to protect YOUR interests, both short term in case there is an emergency or you become incapacitated, and long term to ensure that your ex-spouse is not getting distributions in excess of what is agreed in a divorce settlement. These updates and changes are not to spitefully or fraudulently prevent an ex-spouse from getting what is legally (if not rightfully) theirs. Just because you change distribution clauses in your will or trust, and your fiduciary designations does not mean that your ex-spouse won’t be able to have access to certain property pursuant to a divorce settlement agreement – that agreement will prevail.

Although we are not divorce attorneys, we can certainly assist with any estate planning questions and amendments stemming from a pending or recent divorce. For a personalized review of your current estate, schedule a free consultation to discuss estate planning options, and determine what plan will be best for you and your family.

No information in this blog post is to be construed as, nor is intended to be, legal, financial, nor tax advice. Consult with competent legal counsel and/or tax/financial professionals prior to taking any action. Do not rely on any information contained in this blog post as the law changes from time-to-time and this blog post may not be updated to reflect those changes.

© Zuccaro Law, LLC. All Rights Reserved.