Introduction:

Through this (admittedly lengthy) article, we attempt to provide a relatively comprehensive overview about the changes to the Massachusetts estate tax law by looking at:

- What is an Estate Tax?

- What Property is Included in a Gross Taxable Estate?

- The "old" law which still applies to pre-2023 deaths

- Touching on important changes in the new law

- How to Calculate the Massachusetts Estate Tax

- How to Use Estate Planning to Reduce or Eliminate Massachusetts Estate Tax Exposure

This article doesn’t hit on every single provision of the Massachusetts estate tax law, but provides a comprehensive overview of the law and how it functions. Rather than break this up into multiple smaller posts, leaving everything in one article will allow this to be easier resource to navigate. Stay tuned for additional posts will likely be written on individual aspects of the law.

What is an Estate Tax?

Massachusetts is one of only 17 states (plus D.C.) that have an estate or inheritance tax. An inheritance tax is paid by the beneficiaries, whereas an estate tax is paid from the gross estate prior to distribution. Massachusetts has an estate tax but does not have an inheritance tax.

In 2023, Massachusetts finally increased its estate tax threshold, although barely. Since 1999, the Massachusetts estate tax threshold was stuck at a paltry $1,000,000, and it was not indexed for inflation. With the median sale price of real estate in Massachusetts regularly being near, or exceeding, $600,000 over the last several years, the previous $1,000,000 threshold was easily reachable as a home-owner, on top of savings, retirement, life insurance, and a lifetime of compiling various other assets.

Rather than being a tax on high net worth estates, the Massachusetts estate tax very much became an additional tax on the middle class, and arguably still is because it is still not indexed for inflation.

For comparison sake, here’s how Massachusetts stacks up with our neighboring states:

| State | 2024 Estate Tax Threshold |

|---|---|

| Massachusetts | $2,000,000 (new threshold with 2023 law) |

| Maine | $6,800,000 |

| New Hampshire | NO ESTATE TAX |

| Vermont | $5,000,000 |

| Connecticut | $13,610,000 (tied to federal exemption) |

| Rhode Island | $1,734,583 |

| New York | $6,940,000 |

What Property is Included in a Gross Taxable Estate?

Before we get into HOW an estate is taxed, it is important to know WHAT property is taxed. All property includable in a taxable estate must be reported at its fair market value on the date of the decedent’s death.

In the second part of our series on Massachusetts Probate, we included an explanation of the distinction between a probate estate and a taxable estate. It was noted that a Taxable Estate includes assets owned by decedent at time of their death regardless of joint ownership or beneficiary designation. For Massachusetts estate tax purposes, the gross estate includes, among other things:

- Certain transfers made during the decedent’s life without an adequate and full consideration in money or money’s worth;

- Cash/bank accounts;

- Stocks/investments;

- Bonds;

- Annuities;

- Real Estate (regardless if owned in a joint tenancy with rights of survivorship or as tenants by the entirety);

- Collectibles;

- Jewelry;

- Cars;

- Life insurance proceeds (even though payable to beneficiaries other than the estate);

- Property over which the decedent possessed a general power of appointment;

- Dower or curtesy (or statutory estate) of the surviving spouse, and

- Community property to the extent of the decedent’s interest as defined by applicable law.

Old Massachusetts Estate Tax Law

Threshold and “Cliff Tax”

For deaths occurring prior to January 1, 2023, the “old” law still applies. Prior to the 2023 change, Massachusetts was tied with Oregon for the lowest estate tax threshold in the country at $1 million. The Massachusetts estate tax was also what is called a “cliff tax.” That means that unlike most other tax exemptions where only the amount exceeding the threshold/exemption amount is taxed, Massachusetts effectively taxed the entirety of the estate once it crossed that $1 million dollar threshold (with certain credits applied).

Treatment of Lifetime Taxable Gifts

In the FAQ section in the Estate Planning section of this website, I quip that even though Massachusetts does not have a gift tax, they do like to get cute with gifts because they roll federally taxable gifts back into an estate to determine whether that estate will be taxable – although they are generous enough to not tax you on that amount. This results in otherwise non-taxable estates, because they are below the then $1 million dollar threshold, becoming taxable due to lifetime gifting, though no actual tax is levied on the gift amount.

New Massachusetts Estate Tax Law

The new estate tax law ushered in some welcome changes including:

- An increase to the threshold/exemption amount from $1 million dollars to $2 million dollars.

- With this change, Massachusetts now has the 3rd lowest estate tax threshold in the country just ahead of Oregon and Rhode Island.

- The “cliff” referenced above has been removed through the addition of a new $99,600 credit (a dollar-for-dollar reduction in tax owed). This ensures that estates are only taxed on the amount OVER the $2 million dollar threshold.

Under the new law, a married couple can ultimately shield up to $4 million dollars from Massachusetts estate tax exposure with proper trust planning. Read on for more on how this works and what a trust plan would look like.

Meet the New Law, Same as the Old Law:

Despite these changes, there are still important provisions of the previous law that remained the same:

- The Massachusetts estate tax is still not portable between spouses. This means that a surviving spouse cannot inherit the unused exemption amount of the first spouse to die, as is the case with the federal estate tax.

- The Massachusetts estate tax is still not adjusted for inflation. Absent any action by the legislature, the $2 million dollar exemption will remain stagnate.

Massachusetts Residents with Out-of-State Property:

A quick note for Massachusetts residents with out-of-state property. Our understanding of the way the new law written is that out-of-state property will be included in determining whether an estate is taxable, but that the estate tax will be reduced in proportion to the amount of the estate property located outside of Massachusetts.

Lifetime Gifting:

Due to some uncertainty, lifetime gifting will be discussed separately. This is even confusing for the lawyers, so I will do my best to explain.

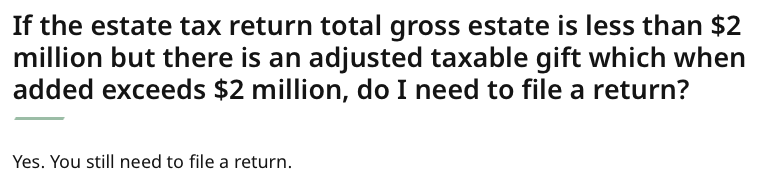

From our reading and understanding of the way the law is currently written, it appears that lifetime gifting is now an available option to reduce a gross estate for Massachusetts estate tax purposes. It appears that taxable gifts will still be rolled back into an estate to determine whether the estate needs to FILE an estate tax return (Form M-706), but no tax will ultimately be owed because the total value of the estate will be under the $2 million dollar threshold.

Theoretically, an individual with an estate in excess of $2 million dollars can now make deathbed gifts to reduce their gross estate to below $2 million dollars, and not pay any estate tax, though they may have to nevertheless file an estate tax return. This differs from the previous law where the estate would still be taxable even though no tax would be paid on the gift amount.

A word of caution, however, for those looking to make taxable gifts. Those of us in the estate planning community are uncertain whether this was the intent of the Legislature. If it was not, this will likely change. We await a ruling from the Department of Revenue.

For what it’s worth, this is all the DOR states about gifts in their FAQ’s about the new estate tax law:

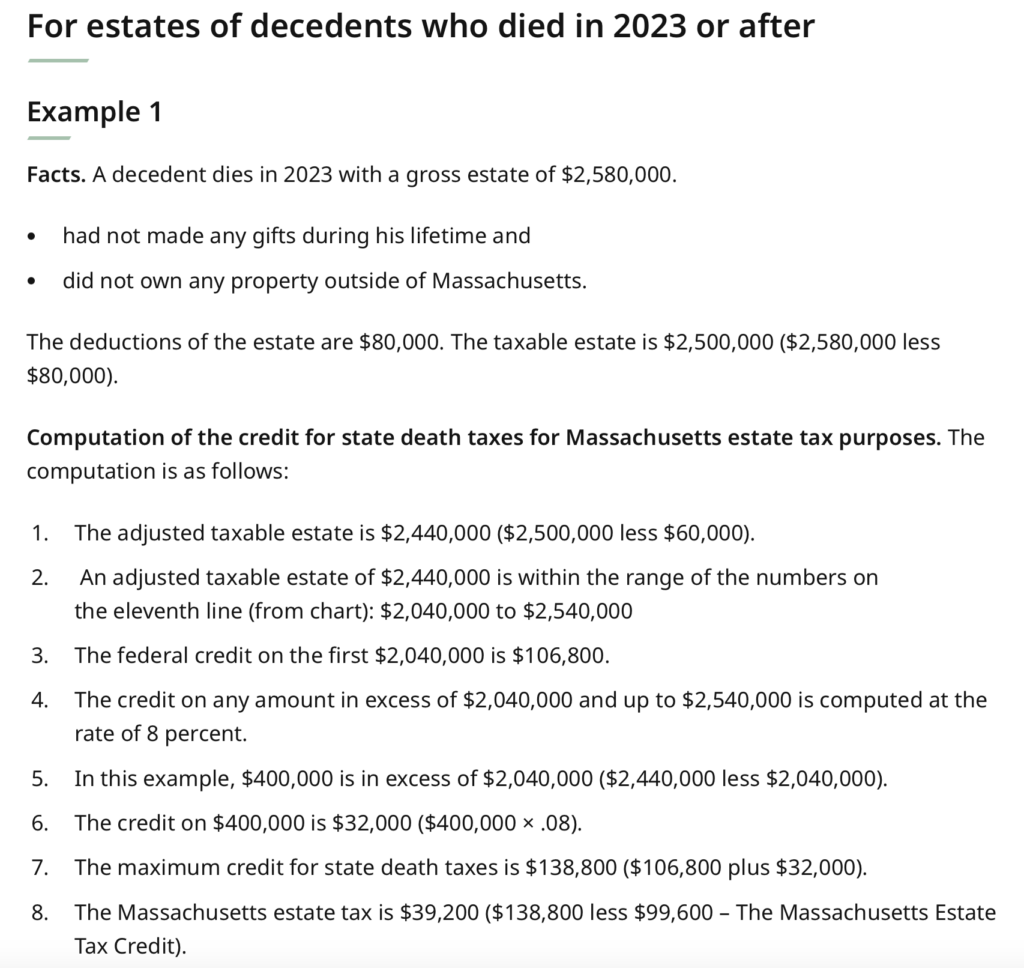

How to Calculate the Massachusetts Estate Tax

Rather than try to reinvent the wheel and provide my own explanation, the Massachusetts Department of Revenue has provided an example of how to calculate the estate tax owed to Massachusetts for deaths occurring on or after January 1, 2023, which I have included a screenshot of below. Ultimately, much like most other tax calculations, it requires a lot of math and utilization of charts.

How to Use Estate Planning to Reduce or Eliminate Massachusetts Estate Tax Exposure

Now that we know what the new law is, what assets are included in the gross estate, and how an estate is taxed under the new law, how does one go about planning to reduce or eliminate Massachusetts estate tax exposure? The following are some estate planning options available to accomplish this goal:

- Making lifetime gifts to family or charity;

- Transfers to spouses. These are usually tax-free, BUT it’s important to make sure you’re not just kicking the estate tax can down the road to the surviving spouse’s estate, and

- Trust planning such as:

- Marital trusts;

- Irrevocable Life Insurance Trust (ILIT);

- Charitable Trusts, and

- Qualified Personal Residence Trusts.

Gifting to Reduce Gross Estate

When we talk about reducing or avoiding federal estate tax exposure (especially during this time of increased estate/gift tax exemption amounts), lifetime gifting, if affordable, is a recommended strategy. For Massachusetts purposes, however, we still have to be careful because Massachusetts may still end up rolling lifetime TAXABLE GIFTS back into a gross estate to determine whether the estate is taxable. However as noted above, the way we understand the new law as currently written, lifetime gifting appears to be an effective means of reducing a gross estate for Massachusetts estate tax purposes.

How Married Couples Can Use Trusts to Reduce or Eliminate Massachusetts Estate Tax Exposure

Trusts can be used to reduce or eliminate estate tax exposure. For more on what trusts are and how they function, read our article: Overview of Basic Trusts and Their Functions.

A typical plan for married couples looking to reduce or eliminate estate tax exposure is a multi-trust plan working in conjunction with the unlimited marital deduction (assets from the first spouse to die pass TAX FREE to the surviving spouse).

This plan includes credit shelter/family (bypass) and marital trusts. The credit shelter trust (“CST”) is funded with the then estate tax exclusion amount (if you are subject to federal estate tax, there could be another CST funded with the then applicable federal estate tax threshold amount less the MA estate tax threshold amount), and the marital trust contains the balance. The result is the funds in the marital trust qualify for the unlimited marital deduction, and the funds in the CST both qualify for the marital deduction AND bypass the surviving spouse’s estate, and are shielded from estate taxes on the deaths of both spouses.

But there’s a catch…

The benefits afforded by utilizing this trust planning doesn’t come without a catch. In order to ensure the funds in the trust qualify for the marital deduction AND estate tax benefits, certain restrictions on the surviving spouse’s access to trust funds must be included. This is typically done using a QTIP (Qualified Terminable Interest Property) trust, which requires an ascertainable standard, usually for health, education, maintenance, and support (commonly referred to as the “HEMS Standard”). Some families don’t like this because the surviving spouse does not have 100% full, unfettered, access to the assets of the first spouse to die. In practice, however, this standard may not be as restrictive as it seems at first blush.

2 Examples to Illustrate How Trusts Reduce/Eliminate Estate Tax Exposure

This can be a relatively complicated process, but I find flow charts provide a helpful illustration of how this works.

The examples below represent an oversimplified illustration of how certain planning can help to reduce or eliminate estate taxes. In this post, we will not get too far into the weeds about certain elections, rules, regulations, or other drafting considerations. Every family dynamic is different, and each plan has pros and cons which should be discussed with an estate planning attorney and tax professionals.

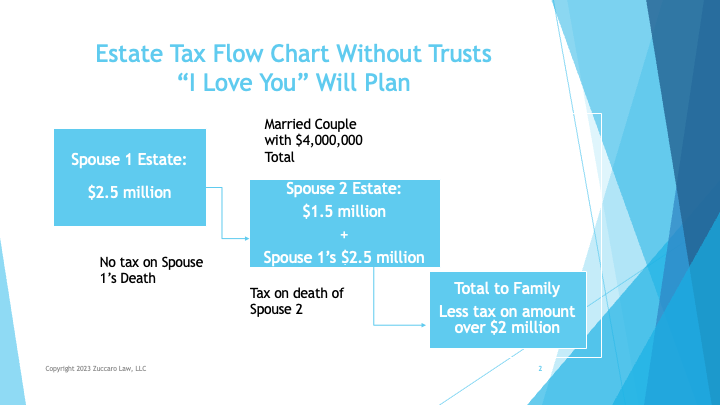

Example 1: “I Love You” Will Plan

Let’s assume we have a married couple with 2 children. Assets are titled such that Spouse 1 has an estate valued at $2.5 million dollars, and Spouse 2 has an estate valued at $1.5 million dollars. In total, this married couple has a net worth of $4 million dollars. If they only have a will plan (no trusts), upon the death of Spouse 1, all assets pass to Spouse 2 tax free due to the unlimited marital deduction. Spouse 2 now has an estate valued at $4 million dollars (Spouse 2’s $1.5 million dollars plus Spouse 1’s $2.5 million dollars).

Assuming Spouse 2 makes no lifetime gifts, nor otherwise spends down their estate to $ 2 million dollars (the MA estate tax threshold amount), upon the death of Spouse 2, estate tax will be owed on the amount in excess of the $2 million dollar estate tax threshold (here the $2 million dollars exceeding the $2 million dollar threshold: $4 million – $2 million). Doing some quick rough math…just under $200,000 in tax.

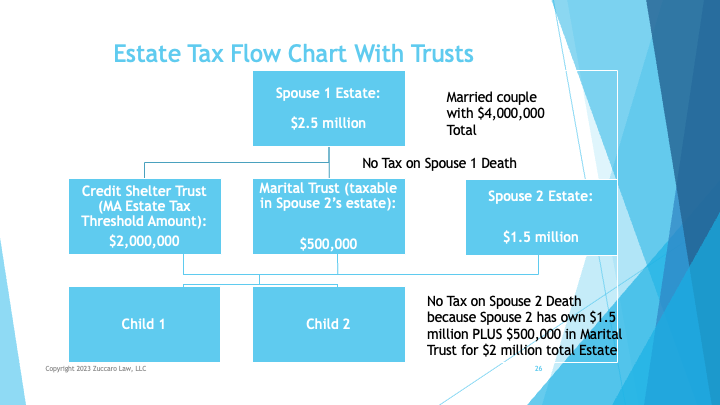

Example 2: Trust Plan

Now, let’s take the same scenario but add trusts. Again, this is just a basic, high-level overview of what a trust plan would look like without getting into specific elections, etc. In this scenario, Spouse 1 funds a Credit Shelter Trust with $2 million dollars (the Massachusetts estate tax threshold amount). The funds in this trust are NOT included in Spouse 2’s estate on the death of Spouse 1. Spouse 1 also funds a Marital Trust with their remaining assets, which ARE includable in Spouse 2’s estate.

In this example, the funds in the CST pass directly to the children, bypassing Spouse 2’s estate. Upon Spouse 2’s death, again assuming no lifetime gifting, Spouse 2’s estate is valued at $2 million dollars (Spouse 2’s $1.5 million dollars plus Spouse 1’s $500,000 from the Marital Trust). Upon the death of Spouse 2, no estate tax is owed because Spouse 2’s estate is valued at $2 million dollars.

Ultimately, by implementing the below trust plan, this couple was able to shield the entire $4 million dollars from Massachusetts estate taxes, saving their family roughly $200,000.

For a personalized review of your current estate, and to review whether proper planning can help reduce or eliminate your Massachusetts estate tax exposure, schedule a free consultation to discuss estate planning options today!

No information in this blog post is to be construed as, nor is intended to be, legal or tax advice. Consult with competent legal counsel and/or tax professionals prior to taking any action. Do not rely on any information contained in this blog post as the law changes from time-to-time and this blog post may not be updated to reflect those changes.

© Zuccaro Law, LLC. All Rights Reserved.